IRS 656-B 2024-2025 free printable template

Instructions and Help about IRS 656-B

How to edit IRS 656-B

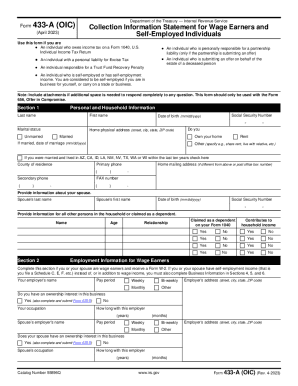

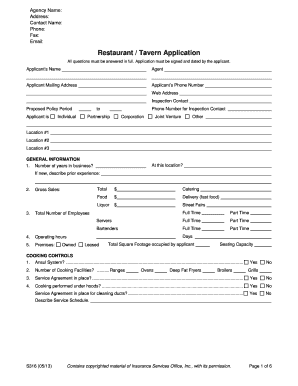

How to fill out IRS 656-B

Latest updates to IRS 656-B

All You Need to Know About IRS 656-B

What is IRS 656-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 656-B

What should I do if I realize I've made a mistake on my submitted IRS 656-B?

If you discover an error after submitting your IRS 656-B, you can correct it by filing an amended form. Make sure to clearly indicate that it is a correction and include any necessary documentation to support the changes. Keeping copies of all correspondence is important for your records.

How can I track the status of my IRS 656-B submission?

To verify the receipt and processing of your IRS 656-B, use the IRS online tracking tools if e-filed, or contact the IRS directly. Common rejection codes can guide you in troubleshooting issues if your submission is not accepted. Maintaining a record of your submission can also be helpful.

What should I do if I receive a notice from the IRS regarding my IRS 656-B?

If you receive a notice or letter from the IRS concerning your IRS 656-B submission, carefully read the communication and gather any required documentation. You will typically need to respond by the specified deadline with the appropriate information or corrections to avoid potential penalties.

Are there any special considerations for filing the IRS 656-B for nonresidents?

When filing the IRS 656-B for nonresidents or foreign payees, it's crucial to understand the specific identification and tax treaty considerations that may apply. Always double-check the IRS guidelines for nonresident forms to ensure compliance and proper processing.

What common errors should I look out for when submitting the IRS 656-B?

Common errors include incorrect taxpayer identification numbers, failing to sign electronically, or not including required attachments. To avoid these issues, meticulously review your form and ensure all sections are completed correctly before submission.

See what our users say