Who needs an IRS 656 form?

This form is an Offer in Compromise, the agreement concluded between the taxpayer and the IRS to reduce the amount of the tax debt. If your Offer is approved by the IRS, you will pay your debt according to a specific program.

What is the purpose of the IRS 656 form?

This form gives the IRS important information about your financial situation. If the IRS officials determine that you are not able to pay your taxes, they will make a plan for paying off the debts.

What documents must accompany the IRS 656 form?

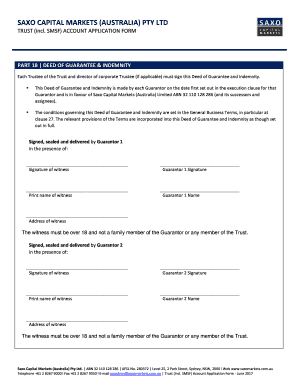

The Offer in Compromise must be filed together with the completed form 433-A or form 433-B, and all the required copies of the documents listed at the end of each form. The applicant also must pay the application fee and attach a check to the offer (you don’t have to pay the fee if you are eligible for a low-income certification).

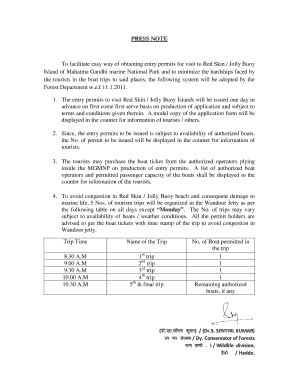

When is the IRS 656 form due?

This form must be sent after you file all the required tax returns for the current tax year, make all the required tax payments or make all the required federal tax deposits.

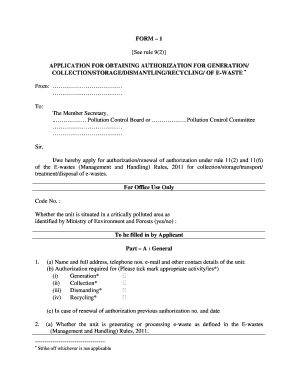

What information should be provided in the IRS form 656?

The taxpayer will add the following information:

-

Personal information and business information

-

Information about tax periods

-

Reasons for offer

-

Low-income certification

-

Payment terms

-

Designation of down payment and deposit

-

Source of funds

-

Offer terms

The form must be signed and dated by the taxpayer as well.

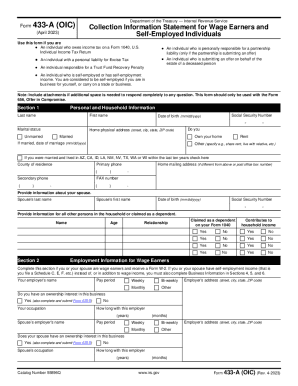

The forms 433-A and B, as part of the Offer in compromise, should also be completed by the taxpayer. These forms ask for the following information:

-

Personal and business information

-

Employment information for wage earners or businesses

-

Information about personal and business asset

-

Information about business asset and expense

-

Information about monthly household (business) income and expense

-

Minimum offer amount

What do I do with the form after its completion?

All parts of the Offer in Compromise are forwarded to the appropriate IRS facility.